Featured Post

Money Laundering Risk Categories

- Get link

- Other Apps

The idea of money laundering is essential to be understood for these working in the monetary sector. It's a process by which dirty cash is transformed into clear cash. The sources of the money in actual are felony and the cash is invested in a means that makes it appear like clear money and hide the identification of the criminal a part of the cash earned.

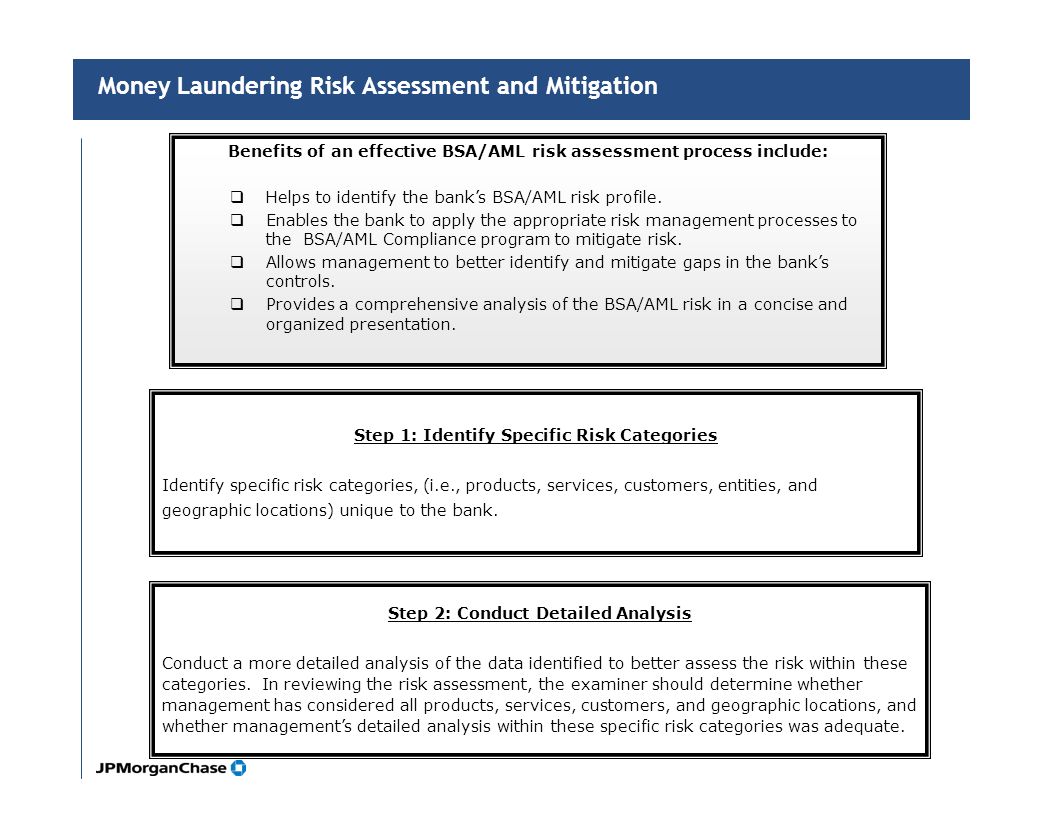

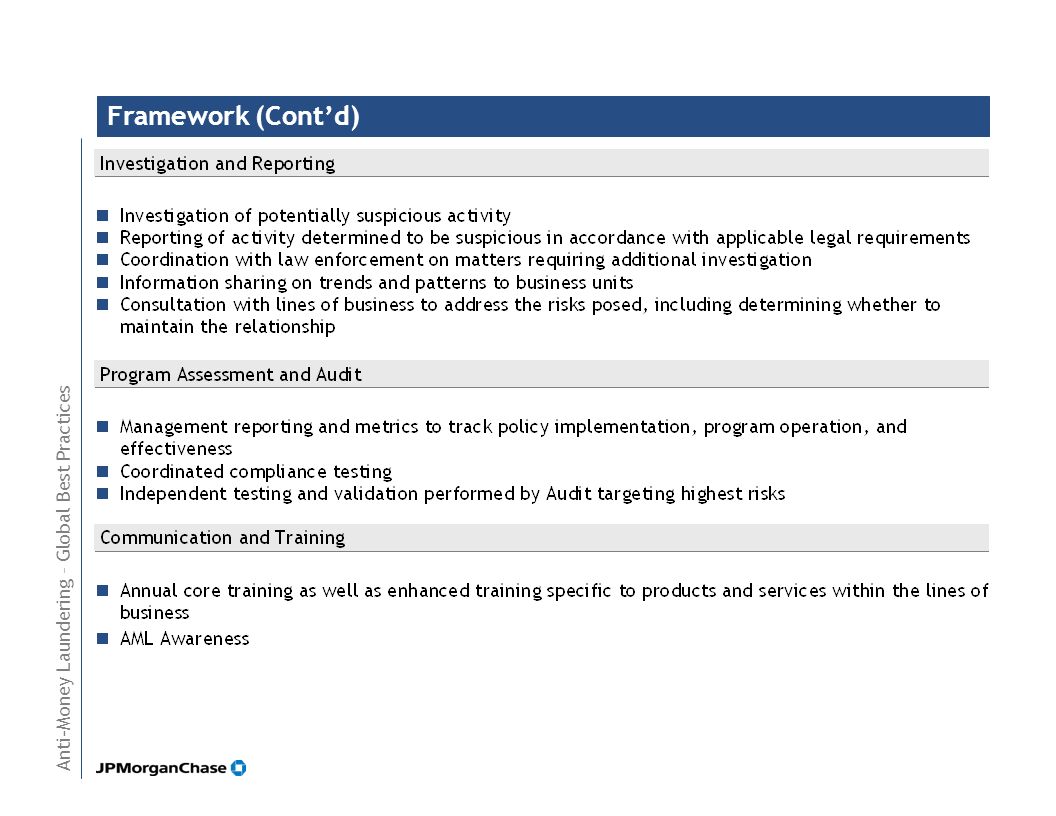

Whereas executing the financial transactions and establishing relationship with the new prospects or maintaining current prospects the responsibility of adopting adequate measures lie on every one who is a part of the group. The identification of such aspect at first is easy to cope with as a substitute realizing and encountering such situations later on in the transaction stage. The central financial institution in any country gives full guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously present sufficient security to the banks to discourage such conditions.

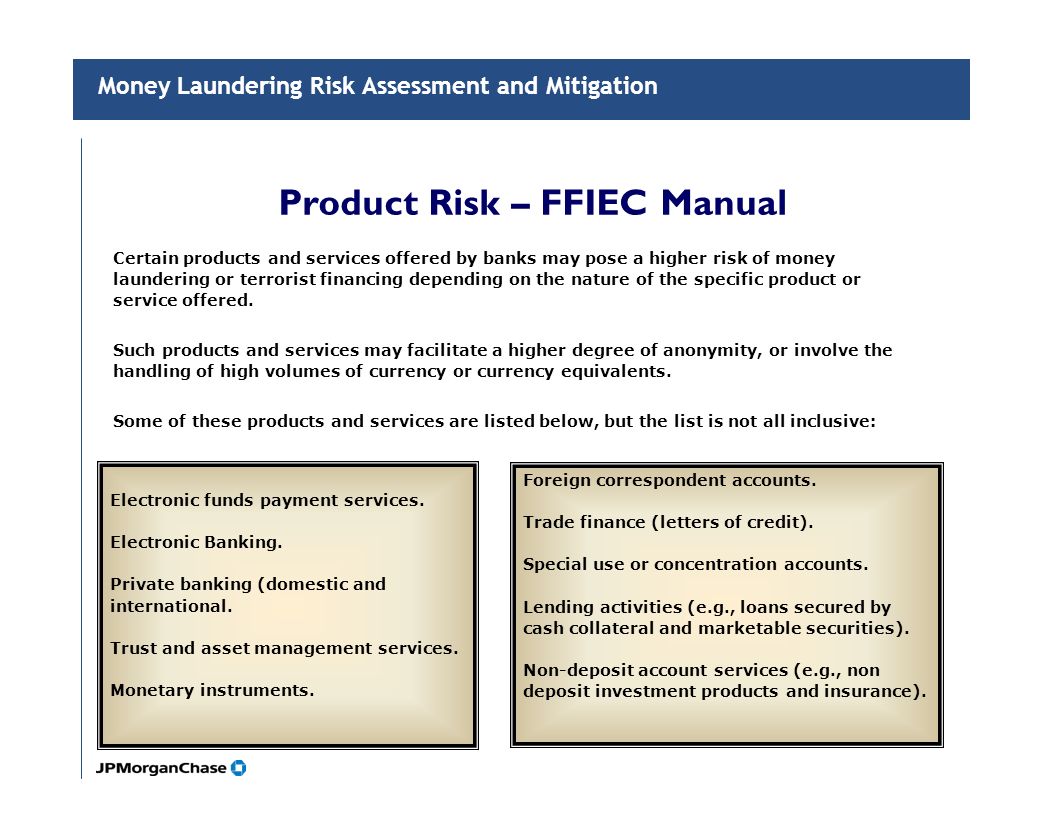

Globally governments have narrowed key risk indicators to five primary divisions of 1 Nature size and complexity of a business 2 Customer types including B2B and B2C 3 the types of products and services provided to customers 4 method of on-boarding new customers and ongoing communications with existing customers and finally 5 Geography risks. These products and services fall under 11 sectors including the 10 sectors or products identified by the 4th Anti-Money Laundering Directive6 along with 1 additional category of products and services relevant for the risk assessment7.

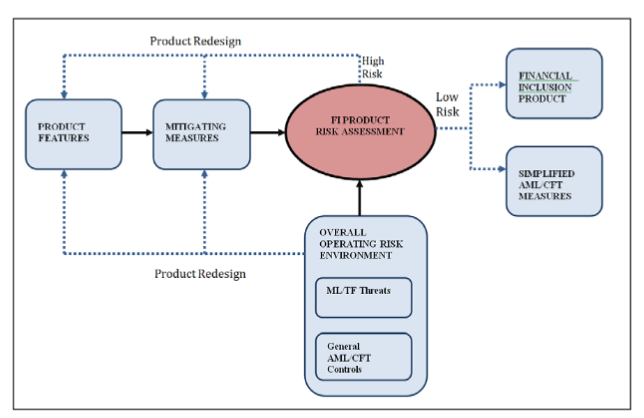

Annex 6 Examples Of Risk Assessment Tools Fatf Guidance Anti Money Laundering And Terrorist Financing Measures And Financial Inclusion With A Supplement On Customer Due Diligence Updated November 2017 Better Regulation

However it is important to note that this classification must ensure that appropriate due diligence measures are implemented in each situation.

Money laundering risk categories. The premise behind the effort is clear. Services that are potentially vulnerable to money launderingterrorist financing risks up from 40 in 2017. New customers carrying out large one-off transactions a customer whos been introduced to you -.

There clearly is not one single methodology to apply to these risk categories and the application of these risk categories is intended to provide a strategy for managing potential money laundering risks. Financial institutions must be able to respond to threats on a contextual basis to balance efficiency and cost needs with compliance obligations. Afghanistan Iran Iraq North Korea Syria Uganda Vanuatu and Yemen since 20 September 2016 Trinidad and Tobago since 14 February 2018 Pakistan since 2 October 2018 The Bahamas Barbados Botswana Cambodia Ghana Jamaica Mauritius Mongolia.

However many countries financial systems are extremely vulnerable to money laundering terrorist financing and related crimes. Your business might be at risk of money laundering from. The risks a bank faces during the money laundering cycle are classified into two categories criminal environment and product and service risk.

The World Bank Risk Assessment Methodology 1. Cloudera from SAS that permit virtually instantaneous reactions to detected anomalies are all expected to be part of the Fifth Money Laundering. If you were planning to drive a sports car over the speed limit would you drive on a road where you knew the police were waiting with their radar.

In addition the European Commission has created a list of high-risk countries on money laundering and terrorism financing including. First Recommendation 12 requires a reporting entity to have òappropriate ó risk management. The risk of money laundering in the legal sector remains high.

Customers in these categories can pose an inherently high risk for money laundering. The risk of terrorist financing in the sector is low. Citizens and governments lose over 110 billion to financial crime and 2 to 5 of global GDP is estimated to be laundered every year.

Unit 2 Risk. Most financial institutions will categorize international wires as high-risk but credit card and merchant acquiring activity will not fall into the same anti-money laundering AML risk category. It promotes crime and corruption that weaken our economies and damage social wellbeing.

Risk of potential money laundering is discretionary with each institution. Specifically AUSTRAC alleges over 23. Scores and Ranking The top 10 countries with the highest AML risk are Afghanistan 816 Haiti 815 Myanmar 786 Laos 782 Mozambique 782 Cayman Islands 764 Sierra Leone 751 Senegal 730 Kenya 718 Yemen 712.

Money laundering ML has devastating consequences. Based on the above the risk classification should in theory include at least two risk categories high and standard risk and possibly a third one low risk. On November 20 2019 AUSTRAC Australias anti money-laundering AML and counter-terrorism financing CTF regulator initiated an action in the Federal Court of Australia seeking civil penalty orders against Westpac Banking Corporation Westpac Australias second largest retail bank alleging systemic failures to comply with Australias AML-CTF laws.

Understanding risk within the Recommendation 12 context is important for two reasons. Money laundering ML or terrorist financing TF risk is the risk that an organisation or a product or service offered by an organisation may be used to facilitate MLTF. Background World Bank has attached high importance to money laundering and terrorist financing risk assessment from the early years of the recognition of risk based approach in AMLCFT area and has helped actively client countries to assess these risks.

The assessment notes that the risk of these services being exploited by criminals increases when legal professionals take a tick box approach to compliance. Unit 1 Risk Assessment for Money Laundering This unit describes the need for combating AML risks and other financial crimes. It is unrealistic that an organisation would operate in a completely risk-free environment in.

More detail on the enhanced due diligence required in specific high-risk cases such as Politically Exposed Persons as well as the incorporation of cryptocurrencies and Blockchain into ML regulation stringent controls on pre-paidcards and further steps towards central registries based on big data analytics eg.

Anti Money Laundering Programmes Systems Financetrainingcourse Com

Risk Based Approach And Overall Risk Assessment Comments And Recommendations By The Nbb Nbb Be

Line Of Business Aml Policies And Procedures Ppt Video Online Download

Anti Money Laundering Programmes Systems Financetrainingcourse Com

Line Of Business Aml Policies And Procedures Ppt Video Online Download

Financial Crime Risk Assessment Acams Today

Anti Money Laundering Risk Assessment Identify The Risks And Vulnerabilities Web Nuk

Line Of Business Aml Policies And Procedures Ppt Video Online Download

Indicators Involved In The Customers Money Laundering Risk Assessment Download Table

Risk Management In Us Msb Institutions Imtc

Eu Policy On High Risk Third Countries European Commission

Table 2 From A Reference Model For Anti Money Laundering In The Financial Sector Semantic Scholar

Https Www Econstor Eu Bitstream 10419 162698 1 891246215 Pdf

Annex 6 Examples Of Risk Assessment Tools Fatf Guidance Anti Money Laundering And Terrorist Financing Measures And Financial Inclusion With A Supplement On Customer Due Diligence Updated November 2017 Better Regulation

The world of regulations can look like a bowl of alphabet soup at instances. US money laundering regulations are not any exception. We have compiled a list of the top ten cash laundering acronyms and their definitions. TMP Threat is consulting agency focused on defending financial services by reducing threat, fraud and losses. We've got big bank experience in operational and regulatory threat. We've a robust background in program administration, regulatory and operational risk as well as Lean Six Sigma and Business Process Outsourcing.

Thus money laundering brings many adverse penalties to the organization due to the risks it presents. It will increase the chance of main risks and the opportunity cost of the financial institution and ultimately causes the financial institution to face losses.

- Get link

- Other Apps

Comments

Post a Comment